Life insurance

Life insurance eases your family's financial burden by covering mortgage payments in the event of your death.

Life insurance

Life insurance can help your family to cope in the event of your death. Your life insurance can be used to pay off some or all of your mortgage. This can take the financial burden from them, giving them one less thing to worry about.

Protect against the unexpected

Life can be unpredictable. That’s why it’s best to prepare yourself for any eventuality, especially when it can impact your loved ones. At Clever Mortgages we can help you find the right type of life insurance to suit you.

If you die without life insurance and have any existing debts, including your mortgage, these will automatically be passed to your next of kin. This can leave your family with financial difficulties, especially if they depend on you as the main income provider or form of childcare. Life insurance acts as a safety net, protecting the ones you love the most if something were to happen to you.

What is life insurance?

Life insurance is a type of insurance that will only pay out in the event of your death. It can’t be used as a savings or investment product and has no cash value unless a valid claim is made.

You can choose the amount of cover you need and how long you will need it for. In return, you and your family will have peace of mind that if something happens to you, they would still be able to keep their home and have financial security.

What about illness or injury?

Life insurance won’t pay out in the event of an illness, accident or disability. To cover for these types of circumstances you should have a look at our critical illness cover and income protection insurance.

Types of life insurance

There are two main types of life insurance; whole-of-life and term life insurance. The type of insurance that is most suitable for you will depend on your situation. If you’re unsure what type of insurance you need, we can work with you to help you get the right product.

Whole-of-life insurance

As the name suggests, a whole-of-life policy will guarantee to pay out whenever you die. This option is typically the most expensive type of life insurance because a claim is inevitable.

Term life insurance

Term life insurance will only pay out during the fixed period set within your policy. This is the most common form of life insurance, as many people only require a payout if they die whilst their mortgage hasn’t been paid off.

There are different types of term life insurance depending on your situation:

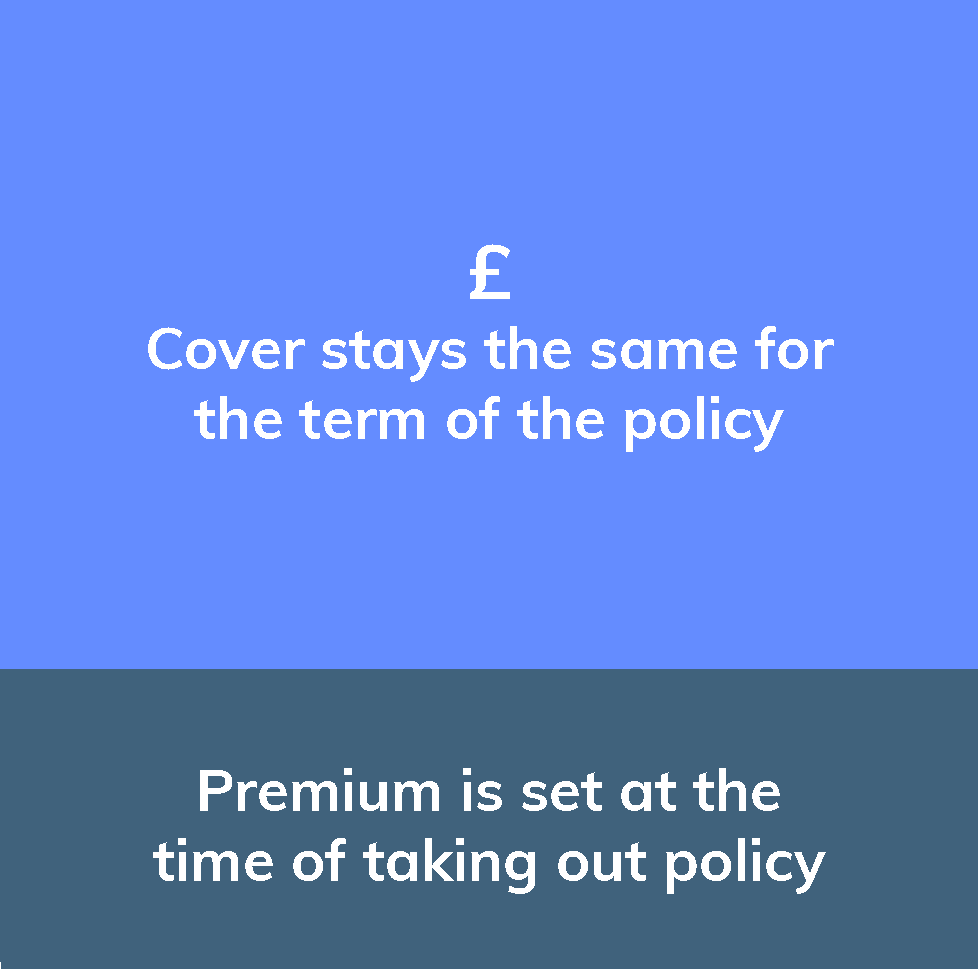

Level term policy

This policy will pay the same amount throughout the entire term unless you change it during that time. With this policy, you will know exactly what your family will be left with in the event of your death.

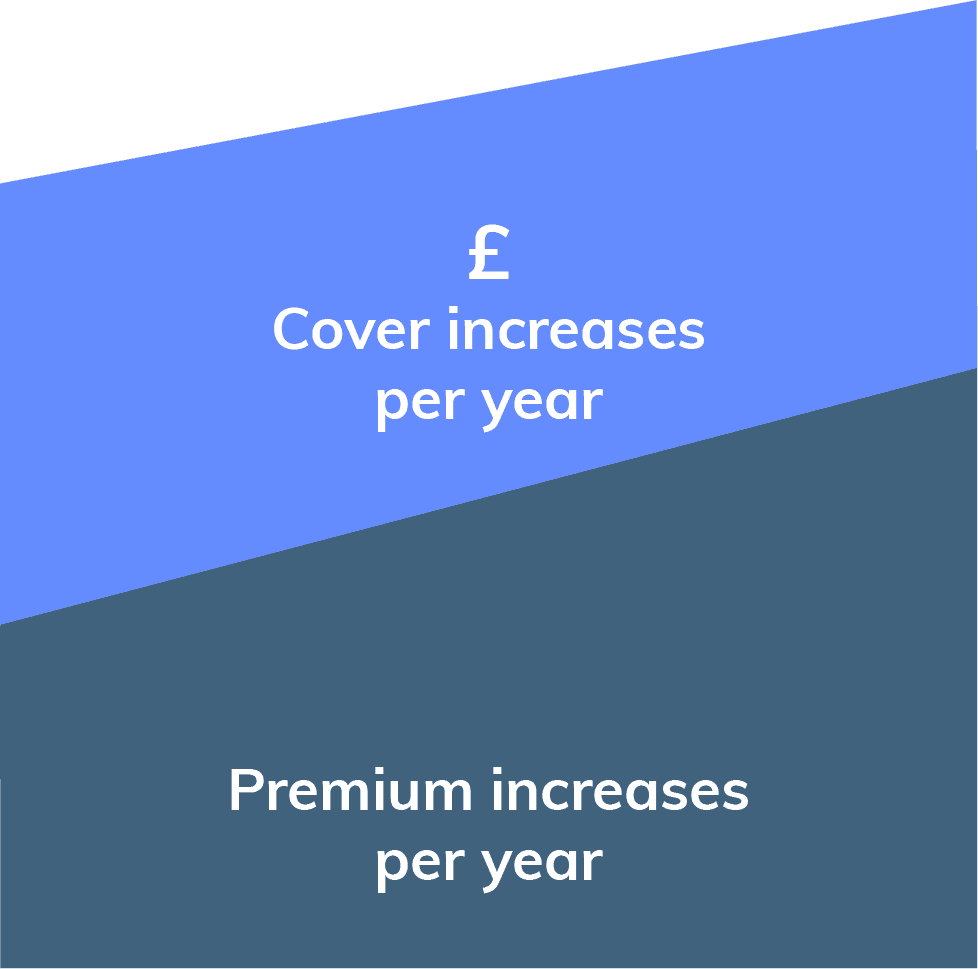

Increasing term policy

An increasing term policy factors in the rising cost of living. Any money paid out will be in line with the Retail Prices Index (RPI), ensuring that the money insured holds is real value throughout the term. However, as the amount insured rises over time, so will the premiums in line with this. Therefore, if you decide this policy is right for you, you should be prepared to pay more as time goes on.

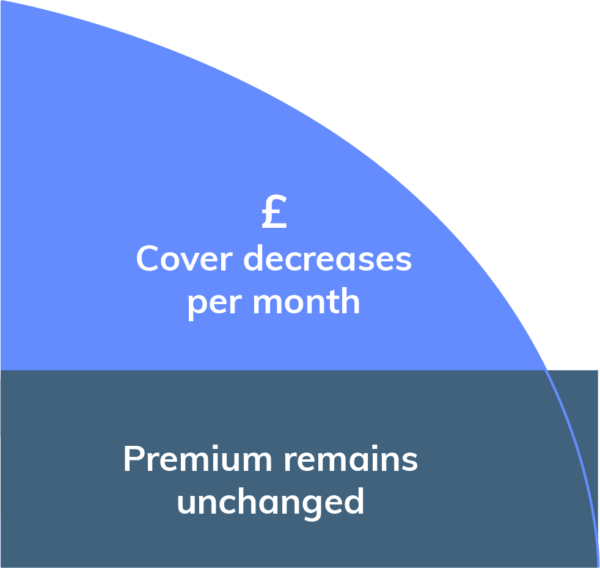

Decreasing term policy

Decreasing term insurance is designed to cover a debt that will gradually reduce over time, such as a mortgage. With this type of insurance, your monthly payments will stay the same, but the overall mortgage debt will decrease. The amount that the insurance company will pay out will also decrease to reflect the remaining debt on your mortgage.

How much does life insurance cost?

The cost of life insurance depends on a number of factors including the policy you take out as well as your age, lifestyle and medical history. So if you are young, active and healthy then, in general, you will pay less for life insurance than someone who is older or someone who has a life-long medical condition.