Family Assist Mortgages

It’s no secret that getting onto the property ladder can be tricky, but mortgage products evolve with the market and there are some routes less commonly heard of.

Standard mortgages typically involve saving up a percentage of the property’s value as a deposit prior to application, which is where a lot of potential buyers can get tied up. Not everyone has the spare cash to save up and put down, even if monthly mortgage repayments would be feasible and within budget.

What is a Family Assist mortgage?

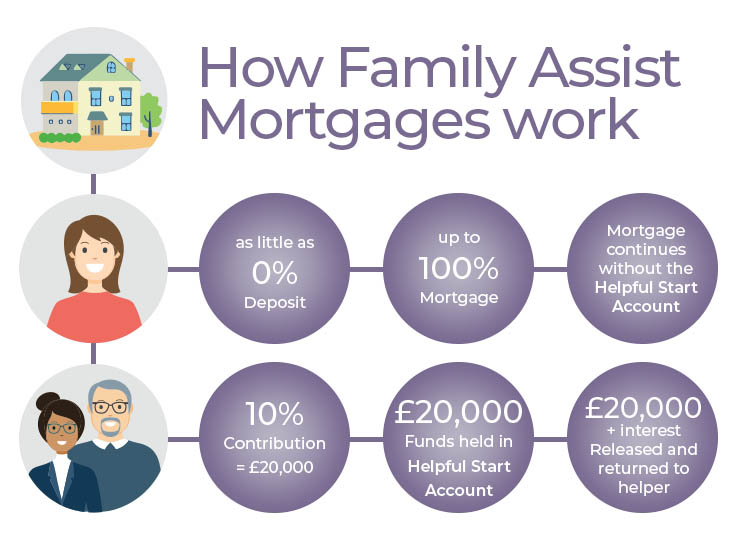

Family Assist mortgages offer a different approach to lending, allowing close family members the chance to help you get your dream home with no (or very little) deposit. To qualify for a Family Assist mortgage, lenders will usually require your family member(s) to provide up to 20% of the property value as security.

If you’ve already saved up some of the deposit, your family member(s) will only need to make up the difference – but it’s worth noting some lenders will only accept applications for this mortgage type if the borrowers’ deposit makes up less than 10%. This means a minimum of 10% needs to be provided as security by your relative(s). Generally, there are two options for your family to provide security;

Savings:

Your family member(s) can deposit their savings into a separate account held by the lender as security. This can be ideal for family members who already have cash set to one side, who want to help but also don’t want to lose their saving by permanently gifting; they can continue to gain interest on their savings, help you get a mortgage to secure your home and still get their money back (assuming the repayments are maintained). Lenders will often accept more than one close family member’s contribution, for example two sets of parents, siblings, aunties, uncles and grandparents. Family Assist mortgages can allow any close relative to help the other, recognising all families work differently.

Once you’ve started repayments, your family members are usually able to withdraw their savings once either a set time has passed or an agreed LTV has been reached on the mortgage. LTV – loan to value ratio, this means the amount you’ve borrowed/are borrowing vs the amount the property is worth. For example at 80% LTV the mortgage represents 80% of the value of the property.

Some lenders offer Family Offset Accounts, which reduces the cost of the mortgage for the borrower by reducing the amount of interest charged. This means the savings won’t be gaining interest, but it can make a significant difference to your monthly mortgage repayments.

Property – collateral charge:

Your family member(s) also have the option to use their property as security, with a collateral charge being taken out against the property they own to the value of say 20% of the property you’re seeking to mortgage (or the difference between your deposit and 20% value).

This can be a perfect solution for homeowners that don’t have a large cash reserve, but still want to help their loved ones raise a deposit and secure a mortgage by using the equity in their own property as security.

It’s important to note that your relative(s) accepting the collateral charge may need to own at least 40% of their property to qualify, and the lender will likely stipulate a standard valuation of your family member(s)’s property. This will be required as part of your mortgage application, which you will be expected to finance. Your close relative may also be subject to a credit check (which they will have to provide written consent for) but this is unlikely to delve into their income/expenditures. Your family member(s) or yourself will also need to pay for any legal costs occurred.

What happens to the security if repayments are missed?

Should you start to fall behind or struggle with meeting mortgage repayments, the lender will usually exhaust all other options before acting on a collateral charge, including contacting the family member(s) that provided the security. The same applies to savings held as security.

Lenders are quite aware of financial difficulties that can arise, and are often more willing to work with borrowers to find solutions rather than take drastic action. Even so, failure to keep up repayments and engage with finding a solution can trigger the security being used to make up any shortfall left on your mortgage should your home be repossessed and sold. As such, it’s important your relatives are aware of the risk they are taking and that you are fully capable of keeping up the repayments over your mortgage term.

Family Assist mortgage term:

Family Assist mortgages usually have a minimum repayment term of 5 years, with the maximum varying, but rarely exceeding 40 years.

Who can get a Family Assist mortgage?

To qualify for a Family Assist mortgage, you need security provided by a close relative, but you also need to be able to keep up repayments and pass affordability checks set out by the lender. You don’t need to be a first-time buyer to be eligible for a Family Assist mortgage, and although this mortgage type is popular with parents and grandparents wanting to help their children/grandchildren, there’s no restriction on helping other relatives.

What fees can I expect?

Most mortgages come with fees, and while Family Assist mortgages can help take out the need for a large cash deposit, there are still other costs that need to be accounted for. Generally, you can expect to pay;

- Booking/arrangement fees

- Valuation on the property – this will be required on the property you are looking to purchase, but will also be needed if your family member(s) are using their property as security

- Survey

- Legal fees – your family member(s) will also need to find, and pay for, their own legal advice

- Stamp Duty

- Land Registry

Some of these fees will vary depending on your mortgage agreement and the lender’s requirements; you can read more about mortgage fees here. Early repayment charges may also be applicable if you decide to repay early or switch mortgage product before the end of your term.

How do I apply for a Family Assist mortgage?

We are used to helping customers from all walks of life and work with a wide panel of lenders, giving us access to products for the most niche situations. Get in touch with one of our specialist advisors at Clever Mortgages to get the ball rolling on finding your ideal mortgage.

If you family want to give you an absolute gift as a deposit to buy a property, lenders will accept this with a letter from the person (s) providing the gift that confirms they aren’t going to ask for it back from you. The lender will need to see bank statements for the account its coming from.